Itr V Acknowledgement 2013 14

Missed out sending of ITR V for AY and? Then you have still time to send the same. CBDT through Notification No. 1/ However, if the return is filed without using digital signature, then the assessee shall send the signed copy of ITR V to CPC, Bangalore at below. Special Campaign by CPC-Send Signed ITR Acknowledgements/ITR-V for AY by 31st October’ The Centralised Processing Cell.

Author: Mazutaur Mozragore Country: Vietnam Language: English (Spanish) Genre: Music Published (Last): 26 August 2013 Pages: 394 PDF File Size: 16.27 Mb ePub File Size: 16.69 Mb ISBN: 632-3-73301-625-4 Downloads: 34405 Price: Free* [ *Free Regsitration Required] Uploader: This status was shown from last two weeks. I was on vacation. How long it typically it for the status to be updated or receive an acknowledgement from them?

Bar code and numbers below the bar code should be clearly seen. But I filled the ITR-1 and submitted as well.

Your Own Advisor – Articles – New income tax forms ITR1 ITR2 ITR3 ITR4,Sugam for AY 14 Hi, I filed my income tax return for the assesment year in June itself through some person and he told that this time we need not post the signed ITRV hard copy to CPC. Did you enter details about Self assessment tax in ITR? So please help me what to do ag when will be my money refunded is there anything that I still need to do. Erwin data modeler pricing. Can anyone please explain me the exact reason. So tax to paid for A.

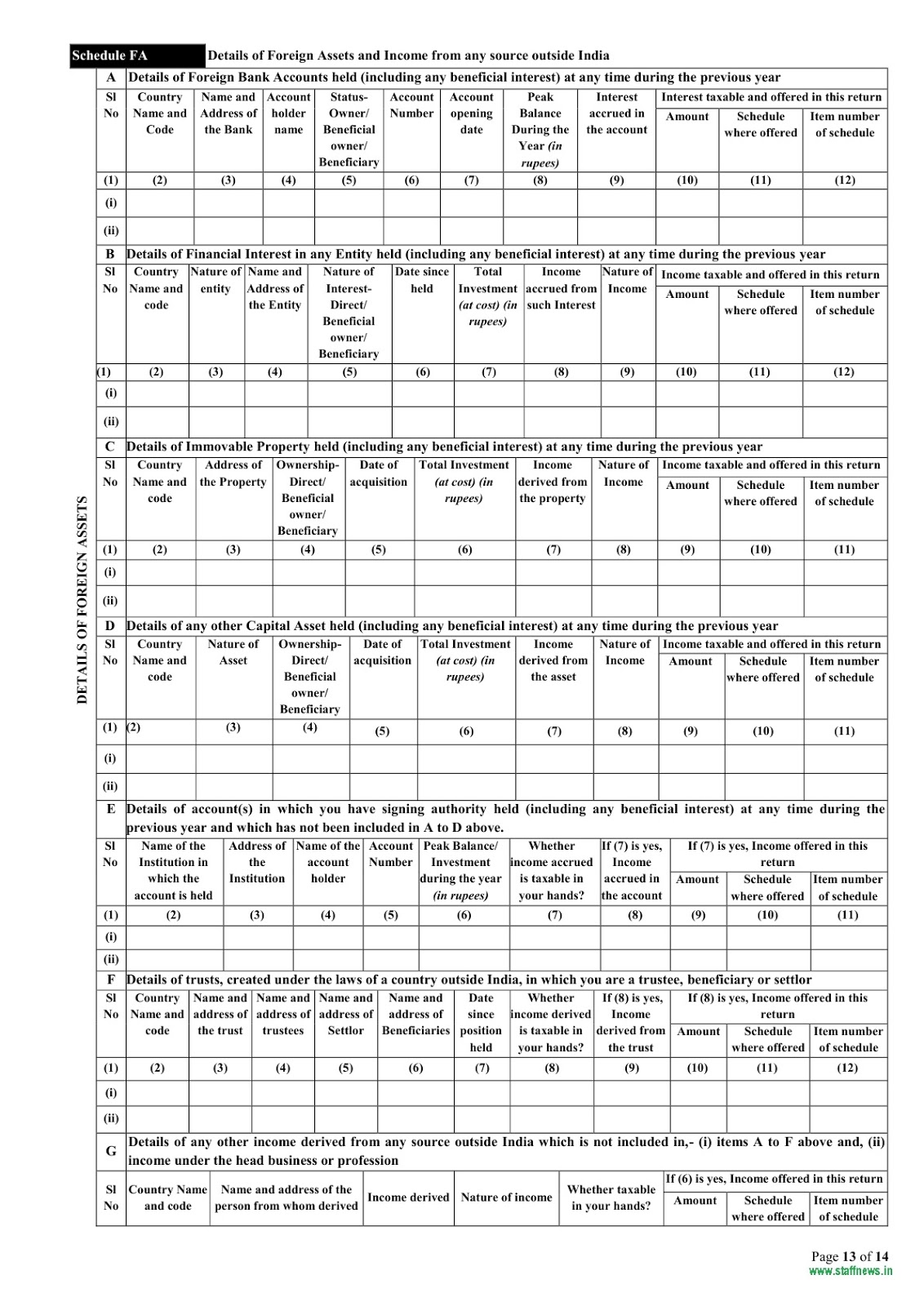

Income Tax Return Forms. Assessment Year 2013-14. Form ITR-1:Sahaj Individual Income Tax Return AY 2013-14; Form ITR-3:For Individuals/HUFs being partners in firms and not carrying out business or profession under any proprietorship; Form ITR-2:For Individuals and HUFs not having Income from Business or Profession.

I have checked the speed post status as delivered in speed post site after ten days But I have not received any mail regarding the receipt status of the ITR V since then. I filed my return before the due date.

The outstanding tax demand can be paid online as below. As per suggested I have checked the Form 26AS. You will get more information and notice. After so many days almost three monthson website the status still shows ITR-V received no other status update processes, rejected etc.

Do I need to pay interest on the refund amount while I pay additional Tax? V Murugan Posted On: How can I rectify this mistake? Thnx a lot Kirti I have done that request long back. Only returns filed under section 1 ie normal return, or returns filed in pursuance of a notice under section can be revised.

I also consult online on a website and get payment after tds whatever number of patients I consult. I am not sure whether this is a valid email or not. Im having my Form Short ans is Hire a CA or Income tax lawyer to help you through the maze. There are a few points to consider, 1. What shall I do?

You need to do corrective action but Let us get the facts right You are talking about return for FY Or AY last date of filing was 5 Aug -when did you get the notice -What does the notice say — order number 1 or 2 or??? ITR V Acknowledgement AY 2013-14 I also observed that in this there is no mismatch in Return I have filled and Calculation as per Income tax. When I checked vv Refund-Reissue Request tab,its showing the request is under progress. The Income tax office will process your return and update you. Itr V was sent by ordinary post. After e-filing ITR: ITR-V,Receipt Status,Intimation u/s 143(1) Expecting a response from you Thanks Johnny. There is some mistake in entries.

Part A shows the TDS which govt has received. If our return is revised then is it take more days to process? I was filling in the details of ITR 1 and before i could make some changes, I accidentally submitted it.

Revised return has been processed. Looks like its done right. E-mail required, but will not display.

It means that the income tax department 2013-114 rejected your refund claim and instead raised an outstanding demand for unpaid taxes.

4 days ago ITR-V stands for Income Tax Return Verification and the IT department generates this for taxpayers to verify the legitimacy of their e-filing. ACKNOWLEDGEMENTAY 4 o. La return of income in.